Khmer Times News: The debt profile of Asean + 3 nations (Japan, South Korea, and China), including that of Cambodia, remains sound but with pockets of vulnerabilities, said a study released last week by Asean+3 Macroeconomic Research Office (AMRO).

While the share of government debt held by nonresidents and denominated in foreign currency (FCY) in some emerging market economies (EMEs) exceeded early-warning thresholds suggested by the IMF, nine substantial portions of external debt stock in these economies came from past official borrowings, the study pointed out.

“The external debts of Cambodia is primarily based on concessional terms. Nevertheless, countries with a significant share of FCY-denominated debt are subject to a higher risk of rising nominal values of debt outstanding and debt service burdens in the event of currency depreciation, as evidenced during the pandemic.

“Although the share of short-term debt, in terms of original maturity, remained low in general, increased reliance on private creditors for external borrowing indicates higher potential risks related to rollover and exchange rate fluctuations amid volatile global financial market conditions.”

The study emphasised that the evolution of the debt-to-GDP ratio is affected not only by fiscal outcomes but also by macroeconomic conditions, particularly through the snowball effects of existing debt. “In particular, the increasing interest rate and growth rate differentials amid recent policy rate hikes will keep it challenging to reduce the debt ratio swiftly by fiscal consolidation alone”.

“While policy efforts to boost growth rates and lower financing costs will help reduce the debt ratio over the medium term, macroeconomic developments are also influenced by fiscal consolidation”. “Generally, fiscal consolidation is regarded as having contractionary effects on aggregate demand and output, lowering economic growth.

“However, some studies suggest the theoretical possibility and empirical evidence of the expansionary effects of fiscal consolidation. While the expansionary effects of fiscal consolidation are inconclusive, credible fiscal consolidation would at least mitigate its contractionary impact and establish a foundation for stable and sustainable growth over the medium term.” During the end of the last year, Cambodia’s public debt stood at $12.01 billion, including the external and domestic debt categories.

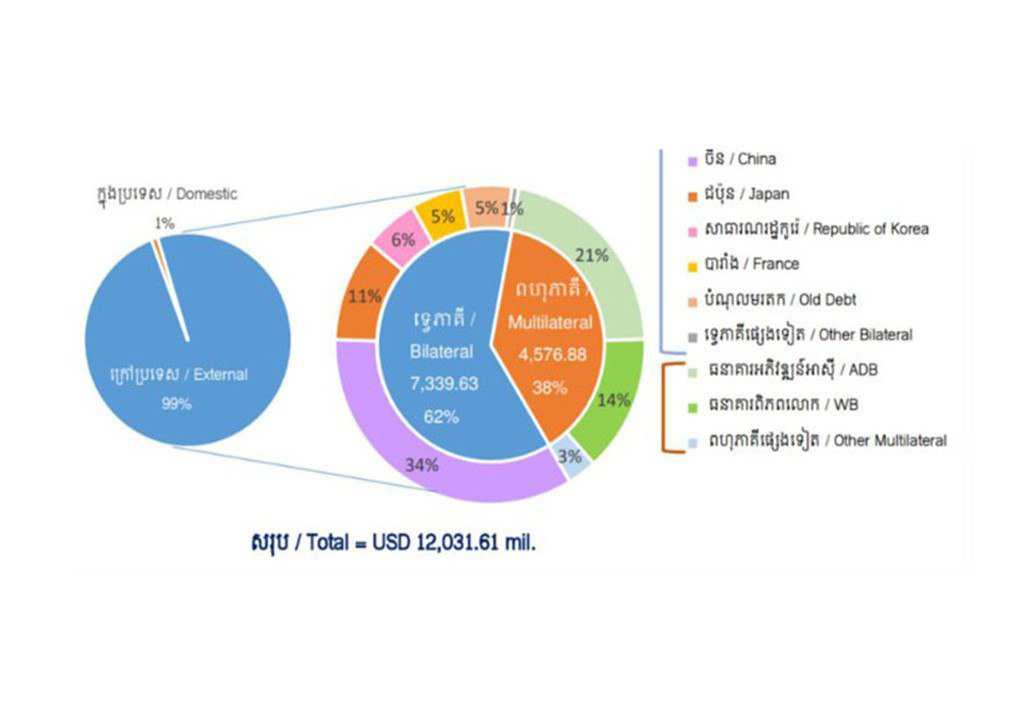

Of the total public debt, 99 percent is external, which the Kingdom owes to international partners. This external debt is divided into two main sources: bilateral loans (62 percent from government-to-government lending) and multilateral loans (38 percent from international organizations like the World Bank). The remaining one percent ($115 million) is domestic debt, owed to lenders within Cambodia. This external debt is denominated in several currencies, with the largest share in US dollars (49 percent), followed by Special Drawing Rights (SDR) at 18 percent.

The remaining debt is in a mix of Japanese yen, Chinese yuan, euros, and local currencies. This diverse mix of currencies helps reduce the risk associated with currency fluctuations, but it also means Cambodia must manage the cost and impact of exchange rate movements.

Apart from loans, the government also raises funds through the issuance of government securities – essentially bonds sold to investors. In 2024, Cambodia issued government securities totalling around $74.86 million.