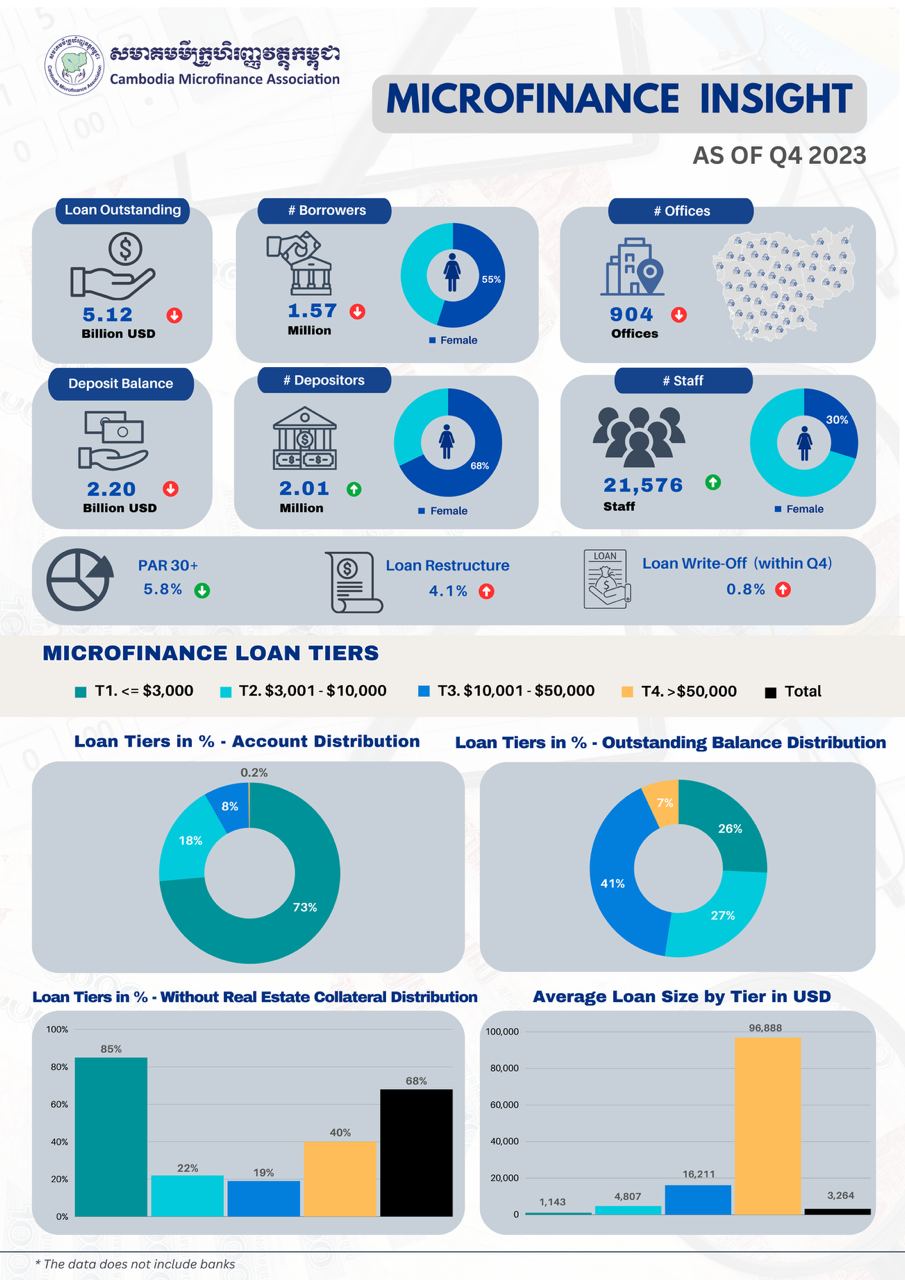

Khmer Times Newspaper: The microfinance sector has provided a credit sum of $5.12 billion to 1.57 million clients, an average of $3,260 per account last year, creating direct employment for 21,567 people nationwide with a business network of 904 offices.

The loan financial report was revealed on Tuesday along with the explanation to the media by Kaing Tongngy, Spokesperson of Cambodia Microfinance Association (CMA) said, “The financial sector is still maintaining excellent stability.”

During the interview, Tongngy said that the microfinance industry in the country continued to maintain good stability amid no significant growth.

In fact, the overall data in 2023 has not proven any remarkable development and in the third and fourth quarters, there has been a slight decrease in the credit size as well as reduced customer demand, he said.

He stressed that above all, the microfinance sector is still among the major factors that play an important role and remain stable and will be able to continue providing various financial services – loans, deposits, and other payment platforms – to the citizens across the whole nation, whether they have high, middle or low income.

CMA year-end report stated, “The microfinance sector – excluding data from banking institutions – provided a total credit of $5.12 billion to 1.57 million customers which provided direct jobs to 21,567 Cambodians of which female workers account for 30 percent of the total employment, having 904 offices networking across the whole Kingdom.”

Speaking to Khmer Times yesterday, Tongngy explained that credits or loans are like a double-edged sword that could help borrowers increase their income speed up their business operations or increase their financial burden.

He said, “Borrowers should use their loan for the right purpose which is to improve their business productivity otherwise the loan interest will become an additional burden in the future.”

“Debts might sound negative but there are good and bad debts depending on their usage. With good strategies and plans, debt will become an additional way to boost income and promote business activities. However, loan repayment should not exceed one-third of income in order to reserve some buffer in case of future uncertainties such as shocks, accidents, or health crises,” he added.

The spokesperson suggested that borrowers should not use informal loans, loan sharks or online loans which charge very high interest rates and do not have client protection mechanisms.

Although access to these unlawful loans may sound easy but so much trouble will come to clients after obtaining loans.

Based on the same report, the four Microfinance Deposit-Taking Institutions (MDI) received a total amount of $2.2 billion, depositing approximately 2.01 million clients by the end of the fourth quarter.

According to the National Bank of Cambodia (NBC), all the four MDIs currently operating in the country built their headquarters in Phnom Penh Capital such as Amret Plc located in Toul Kork District, AMK Plc based in Boeng Keng Kang District, LOLC (Cambodia) Plc can be found in Mean Chey District and lastly is Mohanokor Plc saw their central office in Sen Sok District.

Source from: https://www.khmertimeskh.com